Table of Contents

Payment Gateway: What Does It Mean?

Let’s examine what a gateway for payments is and its functioning principles. It’s a technology that allows people to buy things using solutions for portable gadgets. To put it another way, it acts as a link between a user’s payment and the financial institution that receives it. Because direct contact between clients and banks is restricted owing to security concerns, such intermediation is essential. Vulnerable financial data transported over the Internet may be safely secured and shielded from third-party intervention due to this innovation. However, the adoption of a transaction gateway solution necessitates careful planning. So, let’s discover more of what you should think before this tech integration.Tips to Care About Before the Gateway Development and Integration

Data Protection Certificates

Data protection measures require company owners to supply a Payment Card Industry Data Security Standard (PCI-DSS) in their apps coupled with transaction gateways. Even if your selected gateway is extremely dependable, PCI-DSS is required anyway. In order to certify your software as PCI-DSS compliant, you’ll have to pass a lengthy certification procedure. To begin, you must determine whether the created platform meets the standard requirements and hire pentesters to look for security breaches. Then you should work to resolve the issues you’ve discovered. Finally, one of the professional auditors will decide on your app’s evaluation. However, you should understand that even with such powerful support, you should save your users’ private data only in your databases after payment completion.Merchant Accounts

If you require working with bank cards, merchant accounts are what you need. They function as your online bank accounts allowing you to receive e-transactions. However, you need a banking license to use merchant accounts freely. A merchant account can be formed and linked to transaction gateways if necessary and permitted by the financial institution. The following categories of merchant accounts are available (due to your current business needs):

A dedicated one is an account intended only for your company transactions. It provides greater agility and flexibility and financial management; but, it is more expensive and requires more time for continual monitoring (e.g., security ones).

An aggregate account means you share a bank cell with other businesses. This is a less expensive option than opening a dedicated account, but your funds management function would be restricted. Furthermore, withdrawal processes will take longer.

A merchant account can be formed and linked to transaction gateways if necessary and permitted by the financial institution. The following categories of merchant accounts are available (due to your current business needs):

A dedicated one is an account intended only for your company transactions. It provides greater agility and flexibility and financial management; but, it is more expensive and requires more time for continual monitoring (e.g., security ones).

An aggregate account means you share a bank cell with other businesses. This is a less expensive option than opening a dedicated account, but your funds management function would be restricted. Furthermore, withdrawal processes will take longer.

Kinds of Items For Offering

In case of selling digital goods, you’ll need to meet the in-app transaction policies of the leading marketplaces. They provide developers with the necessary tools. If you offer physical items, both Play Store or Google Play advise using digital payment gateway vendors with specific APIs to communicate with your product. Also Read: QuickBooks Error 404The Most Common Mobile App Transaction Gateway Vendors

It’s time to discuss some of the most prominent gateway vendors from whom you may pick to provide your consumers with a safe transaction alternative. Paypal solutions enable customers (426 million active accounts by the 2021 year-end) to transfer payments worldwide with only an email. It also takes common credit and debit cards and operates in 203 countries. Online invoicing, PCI-DSS compliance, digital terminal usage, speedy checkout, etc. are among its highlights. Authorize.Net is a worldwide transaction gateway with a robust infrastructure and protection to make sure that financial information is passed smoothly, quickly, and reliably. It works in the same way as a card swipe mechanism. The key functions of this gateway include retail payment, client data management, recurring invoicing, etc. The Braintree transaction gateway can work in 40 countries and support 130 currencies while providing quicker and more secure transactions. Its purpose is to simplify transaction procedure, offering commerce tools to help users build international markets, accept payments, and engage in commercial activity.Steps of a Transaction Gateway Implementation

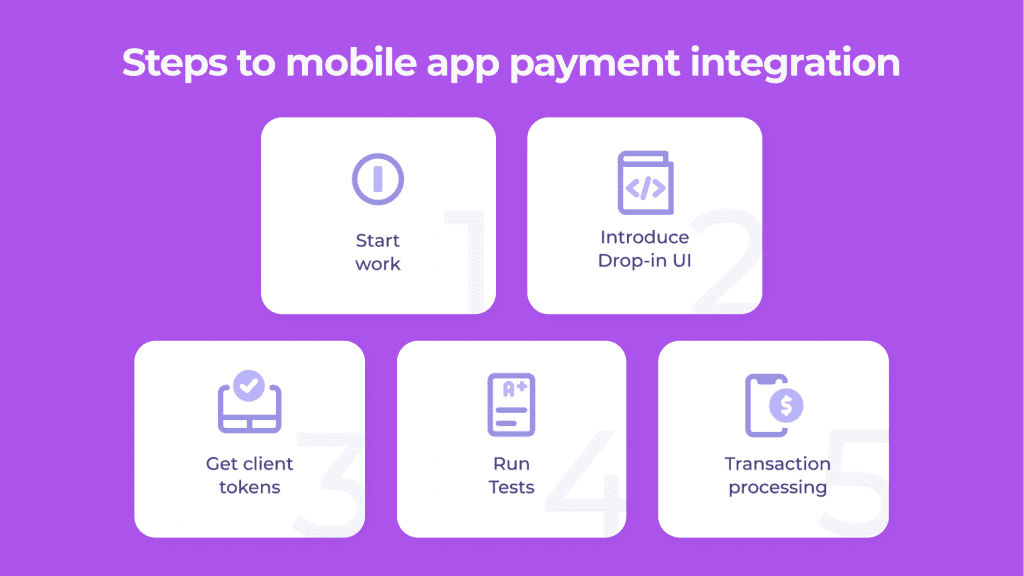

Let’s consider the gateway installation procedures after you hire remote developers with competence in e-commerce solutions development (since it’s more cost-effective than hiring an in-house staff). We used the Braintree service for our integration explanation as to iOS platform. With the Braintree SDK, mobile apps will be able to accept different payment types (PayPal, Apple Pay, etc.). The processes for implementing a gateway into an Android app are the same. Programmers must utilize the Braintree library, which was created specifically for the Android SDK.

The processes for implementing a gateway into an Android app are the same. Programmers must utilize the Braintree library, which was created specifically for the Android SDK.

A Straight Cards Transaction Gateway Implementation

Numerous gateway suppliers allow consumers to conduct money transactions utilizing cards with the help of the mobile application’s API. API-hosted gateways allow users to input their credit or debit card information directly to the merchant’s checkout page. Payments are processed through API or HTTPS requests. Integration of a direct credit/debit card payment channel offers both pros and downsides. And, in order to create a payment gateway solution that is ideal for your project, you must first understand them all.SDK Integration Into a Mobile App

Every supplier has its own SDK, which makes your project team’s job easier. It means that your specialists will spend less time dealing with integration challenges, and you will be less exposed to PCI compliance. For mobile app payment processing, API access is also necessary. Each payment provider has its own APIs, which software developers should utilize in accordance with the customer’s payment gateway solution. Braintree can use the GraphQL and REST APIs. Your team will need to deal with platform-specific gateway solutions if your mobile app sells digital content. Apple Pay for iOS and Google Pay for Android are two essential options to use in this case.Wrapping Up

We told only the fundamentals of payment gateway integration. If you require to learn more, you should apply to a skilled IT vendor. Specialists will answer all the disturbing business questions and help you provide your customers with a safe and secure way to make money transactions through your application. Author’s bio My name is Katherine Orekhova and I am a technical writer at Cleveroad – mobile app development company. I’m keen on technology and innovations. My passion is to tell people about the latest tech trends in the world of IT.

Also Read: Y2Mate Youtube Downloader free